Market Perspectives Blog Post

How Lenders Use Appraisals and When an Appraisal Can Change—Impacting a Transaction

Home appraisals play a crucial role in real estate transactions, particularly for lenders who rely on them to assess the fair market value of a property before issuing a mortgage. While appraisals are meant to provide a neutral, data-driven valuation, they are not always final. In some cases, an appraisal can be revised mid-process, unexpectedly lowered, or even completely overturned—jeopardizing a transaction and forcing buyers, sellers, and agents to rethink their plans.

How Lenders Use Appraisals

Lenders require appraisals to protect their investment by ensuring that they are not loaning more money than a home is worth. Since the property serves as collateral for the loan, an accurate appraisal helps the lender determine:

- Loan-to-Value Ratio (LTV) – The percentage of the loan compared to the home’s value. If the LTV is too high, a lender may require a larger down payment or adjust loan terms.

- Risk Assessment – Lenders use appraisals to evaluate whether a borrower might default. If the home is overvalued, the lender risks losing money if they need to foreclose and resell the property.

- Loan Approval or Denial – If an appraisal comes in too low, it can affect whether a loan is approved at all, forcing buyers to either negotiate a lower price, increase their down payment, or walk away.

A Unique Case: When an Appraisal Changed and Ruined a Transaction

A real-world example of an appraisal impacting a deal involved a buyer under contract on a home for $975,000 in a competitive market. Initially, the appraiser valued the home at $980,000, which was sufficient for loan approval with favorable terms. However, during the underwriting process, the lender conducted a random appraisal review—a common practice when a loan is considered higher risk due to market volatility or specific lender policies. The second appraiser, unfamiliar with the local market, came back with a significantly lower valuation of $910,000, citing concerns over a perceived decline in comparable sales.

This sudden revision threw the entire transaction into jeopardy. The lender, bound by the second appraisal, adjusted the loan terms based on the lower valuation, reducing the loan amount and increasing the buyer’s required down payment by nearly $50,000. The buyer, unable to cover the difference, was forced to either renegotiate the price, switch lenders, or terminate the contract. The seller, unwilling to lower the price, ultimately lost the deal, and the home was relisted.

How an Appraisal Can Change Mid-Process

While most appraisals hold firm, there are instances where lenders or external factors trigger a review or revision, which can unexpectedly impact a transaction:

Appraisal Reviews and Secondary Valuations – Lenders often conduct random appraisal reviews, ordering a second opinion from another appraiser. If the second valuation is lower, the lender may default to the lower number.

Underwriter Challenges – If an underwriter believes an appraisal is inflated or lacks strong comparable sales, they can request an adjustment, leading to a downward revision.

Market Volatility – If the market shifts between the initial appraisal and loan approval, lenders may reassess the valuation, particularly in rapidly cooling markets.

Regulatory Compliance Issues – If an appraisal is flagged for USPAP violations, inaccuracies, or lack of proper documentation, it may be revised or discarded, requiring a new appraisal.

Changes in Loan Type – If a buyer switches from a conventional loan to FHA or VA financing, the new loan may require a stricter appraisal process, leading to different valuation criteria and potentially a new, lower appraisal.

What Can Buyers, Sellers, and Agents Do?

Since an appraisal revision can unexpectedly derail a transaction, preparation and strategy are key:

- For Buyers – Be prepared to cover a potential shortfall between the purchase price and a lower appraisal by securing additional funds or negotiating seller concessions.

- For Sellers – Work with an agent to price the home strategically and ensure the appraiser has access to all relevant upgrades and local sales comps that support the value.

- For Agents – If an appraisal is unexpectedly low, provide additional market data and request a Reconsideration of Value (ROV) from the lender. Agents should also prepare their clients for potential appraisal fluctuations, particularly in uncertain market conditions.

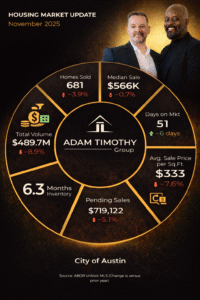

At Adam Timothy Group, we’ve seen firsthand how a revised appraisal can completely shift the course of a transaction. While appraisals are a necessary safeguard for lenders, they can also create significant roadblocks for buyers and sellers. That’s why we work proactively to provide comprehensive market data, assist in negotiating appraisal disputes, and guide our clients through every step of the process. If you have concerns about an appraisal or need expert advice on navigating the real estate market, we’re here to help. Let’s ensure your home transaction moves forward with confidence.

Other Market Perspectives Posts

We don’t just buy and sell homes. We build community by helping clients find their place in the world.

Timothy Powles and Adam Stanley work together on the Adam Timothy Group at Compass RA and manage AT Real Estate Group LLC, a rental and vacation property investment business. We are about building community. We believe a real estate transaction is an important and extremely significant event but relationships last a lifetime. Our clients, partners, and friends trust us to get to know their story and what is most important to them. And we work tirelessly to retain that trust.

INFORMATION ABOUT BROKERAGE SERVICES

INFORMATION ABOUT BROKERAGE SERVICES