How Interest Rate Buy-Downs Can Lower Your Monthly Payment

In today’s real estate market, characterized by persistently high interest rates, many prospective homebuyers are exploring avenues to lower their interest rates without significantly increasing their upfront closing costs. One such avenue that garners attention is the interest rate buydown. Let’s delve into what exactly interest rate buydowns entail, how they function, and the different types available.

Fed Rate Cuts Are Here—But Why Aren’t Mortgage Rates Dropping?

The Fed also updated its economic outlook, and the takeaway is that we might see stronger growth and lower unemployment in 2025—but also slightly higher inflation. Because of that, they’ve scaled back their rate cut predictions for next year from four cuts to just two. Of course, if unemployment starts to climb, they’ve hinted they’ll act faster to adjust.

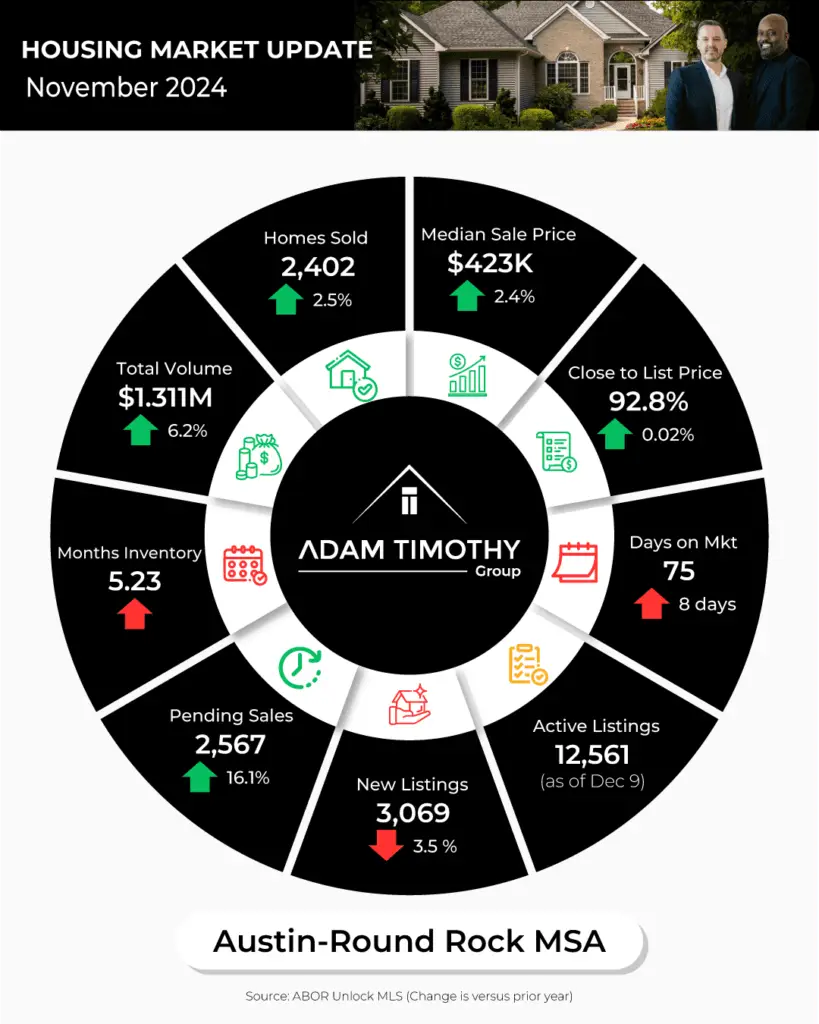

November 2024 Austin Market Trends: Rising Sales, Steady Prices, and Decreasing Inventory

November brought positive momentum to the Austin-area real estate market, with rising home sales, steady price growth, and continued buyer activity. While interest rates remain a factor, buyers and sellers alike are adjusting to the market’s new normal, setting the stage for opportunities as we move into the year-end. Here’s what the numbers—and the trends—mean for you.

High Mortgage Rates? Here’s Why Buying or Selling a Home Now Still Makes Sense

The current housing market is a tug-of-war between buyers hesitant to purchase due to high interest rates and sellers reluctant to list their homes. While both sides seem to be in a holding pattern, the reasons behind this are more nuanced than they appear. For those sitting on the fence, understanding these dynamics could reveal why now might be the perfect time to act.

Why the Latest Fed Rate Cut is a Game-Changer for Homebuyers and Investors

In a bold move, the Federal Reserve just cut interest rates by 50 basis points (0.5%), marking the first time in four years that such a significant reduction has occurred. For those in the real estate market, this could be the perfect moment to make a move. Historically, interest rate cuts like this often lead to lower mortgage rates, which directly impacts your borrowing power and the overall cost of your home. Let’s break down why this matters and why now might be the best time to buy a home or invest in real estate.

Assumable Loans: Bridging the Gap Between Yesterday’s Rates and Today’s Buyers

Assumable Loans: Bridging the Gap Between Yesterday’s Rates and Today’s Buyers

What should Buyers do in light of persistent high interest rates?

At the end of the day, it appears unlikely that interest rates will see drastic changes this year, and it is even less probable that they will return to the historically low levels experienced during the pandemic. According to insights from the Mortgage Bankers Association, while a gradual decline in mortgage rates is anticipated, a new normal around 5% could be expected, marking a shift in what homebuyers might consider a favorable rate moving forward. Understanding these aspects can help buyers make informed decisions in a real estate market characterized by relatively elevated mortgage rates.

Is this the end of elevated interest rates?

At the end of the day, it appears unlikely that interest rates will see drastic changes this year, and it is even less probable that they will return to the historically low levels experienced during the pandemic. For buyers, the projected environment of relatively stable but not drastically reduced interest rates means adjusting expectations and planning accordingly.

Unlocking the Potential of Seller and Lender Funded Incentives for Home Buyers

In a competitive real estate market, distinguishing your property from others is crucial. As outlined by New American Funding, offering incentives can significantly enhance your home’s appeal, making it more attractive to potential buyers . These incentives can range from covering closing costs to providing upgrades or repairs, all aimed at making the buying process more appealing and less burdensome for the purchaser.

Reverse Offers an Interesting Option for Some Sellers

For sellers looking to shake things up and capture the attention of hesitant buyers, considering a reverse offer could be just the strategic move you need. Remember, it’s all about understanding the market and playing your cards right. Happy selling!