Market Perspectives Blog Post

Understanding Home Appraisals: Why They Matter, How They’re Regulated, and the Challenges They Present

Home appraisals play a critical role in real estate transactions, determining the value of a property for buyers, sellers, and lenders. Yet, for many, the appraisal process remains confusing—filled with regulatory complexities, challenges, and shifting industry standards. Whether you’re selling, buying, or refinancing, understanding appraisals is key to ensuring a smooth and informed transaction.

This blog will break down what appraisals are, how they differ from a comparative market analysis (CMA), why they matter, how they’re regulated, common challenges, changes since the Obama administration, how agents get involved, and what options exist to dispute an appraisal. Hang tight! There is a lot to learn.

What Is a Home Appraisal and Why Does It Matter?

A home appraisal is a professional assessment of a property’s fair market value, conducted by a licensed or certified appraiser. It is most commonly required by lenders when a home is being purchased with a mortgage or refinanced. Since the home serves as collateral for the loan, lenders must ensure the property is worth at least the amount they are lending.

For buyers and sellers, appraisals confirm whether the agreed-upon purchase price is reasonable. If an appraisal comes in lower than expected, it can disrupt the transaction, requiring renegotiation or additional funds from the buyer.

Appraisals Are Essential For:

- Home purchases – Lenders require appraisals to determine loan approval and terms.

- Refinancing – Homeowners need an appraisal to establish their home’s value when applying for a new loan.

- Selling a home – Though not mandatory for sellers, appraisals help in pricing strategies.

- Home equity loans – Lenders use appraisals to determine available equity for borrowing.

CMA vs. Appraisal: What’s the Difference?

A Comparative Market Analysis (CMA) and a home appraisal both provide insights into a home’s value, but they serve different purposes and hold different levels of authority.

A CMA is conducted by a licensed real estate agent, not an appraiser. It uses recent sales of comparable properties to estimate value. The CMA helps sellers determine an optimal listing price and assists buyers in making informed offers. It cannot be used for lending purposes or to meet lender requirements.

An appraisal is conducted by a licensed or certified appraiser. It is required by lenders to confirm fair market value before issuing a mortgage. Appraisals follow Uniform Standards of Professional Appraisal Practice (USPAP) guidelines. They are legally binding and recognized by financial institutions for loans and refinances.

How Are Appraisals Regulated?

After the 2008 financial crisis, concerns over inflated property valuations led to stricter regulations to protect consumers and lenders.

- Home Valuation Code of Conduct (HVCC) (2009) – Introduced under President Obama, this rule prevented lenders from directly selecting or influencing appraisers to eliminate conflicts of interest. It also led to the rise of Appraisal Management Companies (AMCs) as third-party intermediaries to assign appraisers.

- Dodd-Frank Act (2010) – Strengthened appraiser independence and introduced tougher oversight to prevent fraud or undue influence.

- USPAP (Uniform Standards of Professional Appraisal Practice) – Establishes ethical and performance standards for licensed appraisers.

While these regulations improved fairness and accountability, they also introduced new challenges.

Challenges in the Appraisal Process

Despite regulatory improvements, several challenges persist in the appraisal process. Appraiser shortages and delays have become a significant issue due to increased industry requirements, which have led many experienced appraisers to leave the profession, resulting in longer wait times—especially in competitive markets. Additionally, overly conservative valuations are common, as appraisers, wary of regulatory scrutiny, sometimes assign values that do not fully reflect market trends, potentially hindering transactions. Another issue is the lack of local market knowledge; since Appraisal Management Companies (AMCs) assign appraisers based on availability rather than regional expertise, some appraisers may not be familiar with the nuances of a specific neighborhood, leading to inaccurate valuations.

Furthermore, concerns over racial and economic bias persist, as studies have shown that homes in minority neighborhoods often receive lower valuations than similar properties in predominantly white areas, prompting industry-wide calls for reform. Lastly, market and housing trends are evolving, with factors like the rise of short-term rentals, co-living spaces, and new zoning regulations adding complexity to the appraisal process, making it more difficult to assess a home’s true value accurately.

What’s Changed Since the Obama Era?

Since the Obama era, several significant changes have reshaped the appraisal industry. One major shift is the increased use of hybrid and automated appraisals, where appraisers rely on third-party data instead of conducting full inspections. The Federal Housing Finance Agency (FHFA) has encouraged the adoption of Automated Valuation Models (AVMs), which use algorithms to assess property values, particularly in refinancing and low-risk loan scenarios. Additionally, appraisal waivers have become more common, with Fannie Mae and Freddie Mac expanding programs that allow certain home sales to proceed without a traditional appraisal if existing market data supports the sale price. Another key change is the growing push for diversity and fairness within the industry, as concerns about racial bias in home valuations have led to efforts aimed at increasing diversity in the appraiser workforce and implementing reforms to promote greater equity in property assessments.

How Do Real Estate Agents Get Involved?

While agents cannot conduct appraisals, they play a key role in supporting fair valuations:

- Providing CMAs – Helps buyers and sellers set realistic expectations.

- Meeting the Appraiser – Agents can share relevant market data and recent comparable sales.

- Helping Clients Prepare – Sellers should present their home in the best condition before an appraisal.

How to Protest a Low Appraisal

If an appraisal comes in lower than expected, buyers and sellers have several options to address the issue. They can request a Reconsideration of Value (ROV) by asking the lender to review the appraisal, providing additional comparable sales or correcting any errors. In some cases, they may be able to order a second appraisal, though lenders do not always permit this. If the appraisal contains clear mistakes, bias, or non-compliance with USPAP standards, filing a formal complaint with the state appraisal board is another route. Buyers and sellers can also negotiate the price to bridge the gap or split the difference to keep the transaction moving forward. Lastly, switching to a different loan program, such as from conventional to FHA, may allow for different appraisal guidelines that could yield a more favorable valuation.

Home appraisals are an essential part of real estate, ensuring buyers, sellers, and lenders understand a property’s fair market value. While regulations have strengthened the appraisal industry, challenges like appraiser shortages, conservative valuations, and potential bias remain. Understanding the difference between a CMA and an appraisal, knowing how agents can help, and being aware of options to contest an appraisal can help buyers and sellers make informed decisions. As real estate evolves with technology and market changes, we can expect appraisals to adapt further, ensuring a fairer and more efficient process for all.

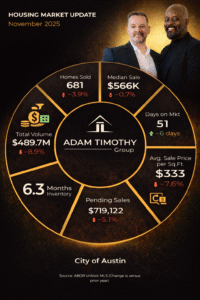

At Adam Timothy Group, we understand that appraisals can be a make-or-break factor in a real estate transaction. Whether you’re buying, selling, or refinancing, we are here to help you navigate the process with clarity and confidence. Our team leverages market expertise, deep industry knowledge, and strategic negotiation skills to ensure that our clients are well-prepared for every step of their real estate journey. We work closely with appraisers, lenders, and industry professionals to advocate for fair valuations and help our clients make informed decisions. If you have questions about an appraisal, need guidance on market value, or want to ensure you’re maximizing your property’s potential, Adam Timothy Group is here to assist. Let’s work together to achieve your real estate goals with confidence and peace of mind.

Other Market Perspectives Posts

We don’t just buy and sell homes. We build community by helping clients find their place in the world.

Timothy Powles and Adam Stanley work together on the Adam Timothy Group at Compass RA and manage AT Real Estate Group LLC, a rental and vacation property investment business. We are about building community. We believe a real estate transaction is an important and extremely significant event but relationships last a lifetime. Our clients, partners, and friends trust us to get to know their story and what is most important to them. And we work tirelessly to retain that trust.

INFORMATION ABOUT BROKERAGE SERVICES

INFORMATION ABOUT BROKERAGE SERVICES