Market Perspectives Blog Post

Understanding the Major Elements of an Offer on a Home Purchase in Texas

When you’re ready to make an offer on a home in Texas, it’s essential to understand the key components that make up your offer. These elements not only outline the terms of your purchase but also protect your interests and ensure a smooth transaction. Here’s a breakdown of the major elements involved:

1. Offer Price

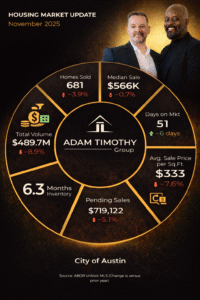

The offer price is the amount of money you propose to pay for the home. This is one of the most crucial parts of your offer, as it directly influences whether the seller will accept or negotiate. Research the local market and recent sales of similar homes in the area to determine a competitive yet reasonable price.

How Adam Timothy Group Can Help: Adam Timothy Group’s deep knowledge of the Texas real estate market ensures that your offer price is competitive and reflective of current trends. We provide you with data-driven insights and expert advice to help you make an informed decision that aligns with your budget and goals.

2. Earnest Money Deposit

The earnest money deposit is a good faith payment made to show the seller that you are serious about purchasing the property. In Texas, this amount typically ranges from 1% to 3% of the offer price. If the deal goes through, this deposit is applied toward your down payment or closing costs. If the deal falls through due to contingencies, you may get this money back.

How Adam Timothy Group Can Help: We guide you through the process of determining the appropriate amount for your earnest money deposit and ensure that it is handled correctly. Our team will explain the conditions under which you can recover this deposit, protecting your investment every step of the way.

3. Financing Contingency

A financing contingency allows you to back out of the purchase if you’re unable to secure a mortgage. This protects you from being obligated to buy a home you can’t afford if your loan application is denied. The offer should specify the type of financing you plan to use and include a deadline for securing your loan.

How Adam Timothy Group Can Help: The Adam Timothy Group works closely with trusted mortgage partners to help you get pre-approved and find the best financing options. We also ensure that your financing contingency is clearly defined, giving you peace of mind as you move forward with your purchase.

4. Inspection Contingency

The inspection contingency gives you the right to have the home inspected by a professional before the sale is final. If significant issues are discovered, you can negotiate repairs, ask for a price reduction, or even walk away from the deal without penalty.

How Adam Timothy Group Can Help: Our team connects you with top-rated home inspectors and helps you interpret the inspection report. We then negotiate on your behalf to address any issues that arise, ensuring that the home you purchase is in the best possible condition.

5. Option Period

In Texas, the option period is a designated time frame during which you can back out of the contract for any reason, typically 7 to 10 days. You pay a small fee for this option, which is usually non-refundable but gives you the flexibility to change your mind after further consideration or additional inspections.

How Adam Timothy Group Can Help: We manage the option period for you, making sure all inspections and evaluations are completed within the allotted time. Our proactive approach ensures that you have all the information you need to make an informed decision, without feeling rushed.

6. Closing Date

The closing date is when the sale is finalized, and ownership of the property is transferred to you. Your offer should specify a closing date that is realistic and aligns with your financing process. Both you and the seller must agree on this date.

How Adam Timothy Group Can Help: Adam Timothy Group coordinates with all parties involved, including lenders and title companies, to set a realistic closing date. We keep the process on track, ensuring that you can close on time without unnecessary delays.

7. Seller Concessions

In some cases, you might request the seller to cover certain closing costs or make specific repairs before closing. These are known as seller concessions and can be an essential part of your offer, particularly if you’re trying to minimize out-of-pocket expenses.

How Adam Timothy Group Can Help: Our experienced negotiators at Adam Timothy Group work diligently to secure favorable seller concessions on your behalf, helping you save money on closing costs and ensuring necessary repairs are made before you move in.

8. Home Warranty

Including a home warranty in your offer can provide peace of mind by covering certain repairs and maintenance costs for the first year after purchase. In Texas, you can ask the seller to provide this, or you can purchase it yourself.

How Adam Timothy Group Can Help: We help you evaluate the need for a home warranty and can negotiate its inclusion in your offer. If you decide to purchase a warranty independently, we guide you in selecting a plan that offers the best coverage for your new home.

9. Personal Property

Sometimes, buyers want specific items like appliances or furniture included in the sale. If there are any personal property items you want to be included, make sure to list them in your offer. However, keep in mind that this could affect the seller’s decision.

How Adam Timothy Group Can Help: Adam Timothy Group assists you in identifying and negotiating for personal property items that you wish to include in the sale. We ensure these requests are handled tactfully, balancing your needs with maintaining a strong, competitive offer.

Making an offer on a home in Texas involves several critical elements, each of which plays a role in the overall success of your purchase. By understanding these components, you can craft a well-rounded offer that protects your interests and increases your chances of securing the home you want. Adam Timothy Group’s expertise in navigating these elements ensures that your home-buying process is smooth, informed, and successful. Always work closely with your real estate professional (hopefully that is us!) to tailor your offer to your specific situation. Happy home buying!

Forms Used in Making an Offer

In Texas, when writing an offer to purchase a home, the most commonly used forms are provided by the Texas Real Estate Commission (TREC). These forms ensure that all necessary information is included in the offer and that the transaction complies with state laws and regulations. Below are some of the key forms typically used in the offer process:

1. TREC One to Four Family Residential Contract (Resale) – Form 20-16

This is the standard form used for most residential property transactions involving single-family homes, duplexes, triplexes, or fourplexes. It outlines the terms and conditions of the sale, including the purchase price, financing details, contingencies, and any seller concessions.

2. TREC Third Party Financing Addendum – Form 40-9

If the purchase involves third-party financing, such as a mortgage loan, this addendum is included to detail the financing terms. It also protects the buyer if they are unable to secure the necessary loan, allowing them to terminate the contract without penalty.

3. TREC Addendum for Sale of Other Property by Buyer – Form 10-6

This form is used when the buyer needs to sell their current home before purchasing the new property. It includes terms that allow the buyer to back out of the purchase if their existing home doesn’t sell by a specified date.

4. TREC Addendum for Property Subject to Mandatory Membership in a Property Owners Association – Form 36-8

This addendum is used when the property being purchased is part of a homeowners association (HOA). It details the buyer’s responsibilities regarding HOA fees and regulations, as well as any associated risks.

5. TREC Seller’s Disclosure Notice – Form OP-H

Although this form is typically completed by the seller, it’s an important part of the offer process. The Seller’s Disclosure Notice provides the buyer with information about the property’s condition, including any known defects or issues. Reviewing this document helps buyers make informed decisions and negotiate repairs or price adjustments.

6. TREC Residential Condominium Contract (Resale) – Form 30-16

This form is specifically used for purchasing residential condominiums. It includes additional details pertinent to condos, such as assessments, association fees, and any shared amenities or responsibilities.

7. TREC Option to Terminate – Paragraph 23 of Form 20-16

This section of the One to Four Family Residential Contract is crucial in Texas real estate transactions. It gives the buyer the option to terminate the contract during the option period, usually 7 to 10 days, in exchange for a nominal fee. This period allows the buyer to conduct inspections and reconsider their purchase without losing their earnest money deposit.

8. TREC Addendum Concerning Right to Terminate Due to Lender’s Appraisal – Form 49-1

This addendum is used when the buyer’s ability to obtain financing is contingent upon the property’s appraisal value meeting or exceeding the loan amount. It provides the buyer with the option to terminate the contract or renegotiate if the appraisal comes in lower than expected.

Other Market Perspectives Posts

We don’t just buy and sell homes. We build community by helping clients find their place in the world.

Timothy Powles and Adam Stanley work together on the Adam Timothy Group at Compass RA and manage AT Real Estate Group LLC, a rental and vacation property investment business. We are about building community. We believe a real estate transaction is an important and extremely significant event but relationships last a lifetime. Our clients, partners, and friends trust us to get to know their story and what is most important to them. And we work tirelessly to retain that trust.

INFORMATION ABOUT BROKERAGE SERVICES

INFORMATION ABOUT BROKERAGE SERVICES