Your Complete Guide to Austin Neighborhoods

Complete Guide to Austin Neighborhoods | Adam Timothy Group Your Complete Guide to Austin Neighborhoods Explore nine of Greater Austin’s most sought-after areas. From urban

When managing a rental property, one of the best strategies you can adopt is keeping your rental business separate from your personal life and other ventures. This separation is crucial for staying organized, protecting your personal assets, and simplifying tax time. While creating a Limited Liability Company (LLC) can be a helpful way to achieve this separation, it’s important to understand that the decision to use an LLC is distinct from the decision to keep your rental finances separate.

Why Separating Your Rental Finances is Essential

Whether or not you decide to form an LLC, keeping your rental property finances separate from your personal accounts is a critical practice. By opening a separate bank account specifically for your rental property, you ensure that all income and expenses related to the property are clearly organized. This separation makes it easier to track your property’s performance, identify deductible expenses, and provide a clear paper trail for tax purposes.

Having a separate account helps prevent your rental income and expenses from getting mixed up with your personal finances or other business ventures. This clarity can be invaluable when making decisions about your property, such as determining how much to budget for repairs or whether it’s time to increase rent.

How an LLC Enhances Protection and Organization

While keeping your rental finances separate is important on its own, forming an LLC adds another layer of protection and organization. An LLC creates a legal barrier between your personal assets and your rental property, which can protect you in the event of a lawsuit or other legal issues.

By holding your rental property in an LLC, you create a formal structure that not only separates finances but also limits your personal liability. This means that if something goes wrong with the property, your personal assets—like your home or savings—are generally protected from being pursued in legal claims.

Simplifying Tax Time with a Clear Separation

At tax time, having your rental property finances separate from your personal accounts can simplify the process significantly. With everything organized in its own account or through an LLC, you can easily identify all income and expenses related to the property. This organization helps you take full advantage of tax deductions and reduces the risk of errors, making tax filing a more straightforward process.

Making the Right Decision for Your Situation

While both separating your rental finances and forming an LLC offer distinct advantages, it’s important to evaluate what’s best for your specific situation. You can keep your rental finances separate without forming an LLC, and this alone can offer significant benefits in terms of organization and simplicity. However, if you’re looking for additional liability protection, an LLC might be the right choice for you.

At the Adam Timothy Group, we’re here to help you navigate these decisions. We understand the challenges of managing rental properties and are committed to providing you with the guidance you need to make the best choices for your business.

An informed client is a great partner in the real estate home buying or home selling process. We want to share with you insights on the market so that you are better informed. We are here for buyers and sellers to make sense of the often tough market. Don’t go it alone. Let’s talk today! If you need help leasing out your luxury condo or single-family home, we may be a good fit for you.

Complete Guide to Austin Neighborhoods | Adam Timothy Group Your Complete Guide to Austin Neighborhoods Explore nine of Greater Austin’s most sought-after areas. From urban

We hear it constantly from clients, from friends, from strangers at open houses: “Should I rent or should I buy?” And every time, the same well-meaning advice follows. The financial news sites publish their monthly scorecards. The online calculators spit out a number. Your uncle at Thanksgiving has strong opinions.

Access to excellent medical care is rarely a limiting factor when choosing a community. With multiple nationally-ranked hospital systems strategically positioned throughout the five-county metro, most areas offer strong healthcare options within minutes. That said, understanding the landscape helps—so here’s your complete guide.

Legacies: Black Excellence | Adam Timothy Group Every Month is Black History Month because Black History is American History Legacies Black Excellence Celebrating the trailblazers

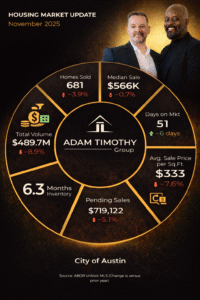

Austin Market Update • November Austin Housing Inventory Is Up: What November Means for Buyers and Sellers Inventory is changing how decisions get made in

How Schools Should Factor Into Your Austin Home Search | Adam Timothy Group Home Buying Strategy • Austin Living How Schools Should Factor Into Your

We don’t just buy and sell homes. We build community by helping clients find their place in the world.

Timothy Powles and Adam Stanley work together on the Adam Timothy Group at Compass RA and manage AT Real Estate Group LLC, a rental and vacation property investment business. We are about building community. We believe a real estate transaction is an important and extremely significant event but relationships last a lifetime. Our clients, partners, and friends trust us to get to know their story and what is most important to them. And we work tirelessly to retain that trust.

INFORMATION ABOUT BROKERAGE SERVICES

INFORMATION ABOUT BROKERAGE SERVICES

We may use cookies and similar technologies to improve your browsing experience, analyze website traffic, and personalize content. By continuing to use this site, you consent to our use of cookies in accordance with our Privacy Policy. You can change your cookie preferences at any time in your browser settings.

Manage your cookie preferences below:

Essential cookies enable basic functions and are necessary for the proper function of the website.

These cookies are needed for adding comments on this website.

Statistics cookies collect information anonymously. This information helps us understand how visitors use our website.

Google Analytics is a powerful tool that tracks and analyzes website traffic for informed marketing decisions.

Service URL: policies.google.com (opens in a new window)

Marketing cookies are used to follow visitors to websites. The intention is to show ads that are relevant and engaging to the individual user.

OptinMonster is a powerful lead generation tool that helps businesses convert visitors into subscribers and customers.

Service URL: optinmonster.com (opens in a new window)

You can find more information in our Privacy Policy.