Market Perspectives Blog Post

Smart Savings: Understanding Permanent and Temporary Mortgage Buydowns

When it comes to securing a mortgage, navigating interest rates can feel like a daunting task. But what if you could lower your rate and make your payments more manageable? Enter mortgage buydowns—a financial tool that lets you reduce your interest rate, either temporarily or permanently, depending on your needs. Whether you’re looking for a way to ease into your payments with a temporary buydown or you want to lock in long-term savings with a permanent buydown, understanding these options can help you make the most of your home financing. In this blog, we’ll break down both types of buydowns and how they can benefit you as a savvy homebuyer.

How a Permanent Rate Buydown Works

Financial Sense for the Borrower

The reason this can make financial sense for a borrower is that the reduced interest rate lowers their monthly payments over the entire life of the loan, which can result in significant savings over time. The longer the borrower stays in the home, the more they save. If the savings from the lower monthly payments exceed the cost of the points paid upfront within a reasonable time frame (typically a few years), the buydown is considered a good investment.

Financial Sense for the Lender

From the lender’s perspective, the interest rate buydown makes financial sense due to several factors:

- Upfront Payment: The lender receives an upfront payment for the points, which can be immediately put to use. This can be reinvested or used to improve liquidity, which is valuable for the lender.

- Risk Mitigation: By offering a lower rate in exchange for upfront cash, the lender mitigates some of the risk associated with potential future interest rate drops or prepayments. Essentially, the lender is compensated upfront, which reduces the risk of losing interest income if the borrower pays off the loan early.

- Attracting Borrowers: Offering a buydown option can make the lender more competitive in attracting borrowers, especially in a market where interest rates are high. The lender can market this option to appeal to those who want lower monthly payments and are willing to pay extra upfront.

- Discounted Cash Flow: Even though the lender receives lower monthly payments due to the reduced interest rate, the upfront payment compensates for this lower income. The lender can calculate that the present value of the cash flows from the lower monthly payments plus the upfront payment equals or exceeds the present value of cash flows at the original interest rate without the buydown.

How a Temporary Buydown Works

In a temporary buydown, the loan’s interest rate is lowered for a specific period, and then it gradually increases to the original rate specified in the loan agreement. There are a few common structures for temporary buydowns:

- 3-2-1 Buydown: The interest rate is reduced by 3% in the first year, by 2% in the second year, by 1% in the third year, and then it returns to the full rate for the remainder of the loan term.

- 2-1 Buydown: The interest rate is reduced by 2% in the first year and by 1% in the second year, then returns to the full rate in the third year.

- 1-0 Buydown: The interest rate is reduced by 1% in the first year, and then it returns to the full rate starting in the second year.

Example of a 2-1 Buydown

Let’s say a borrower takes out a $300,000 mortgage with a 6% fixed interest rate. Under a 2-1 buydown:

- Year 1: The interest rate is 4% (2% lower than the original rate). The monthly payment is based on this reduced rate.

- Year 2: The interest rate is 5% (1% lower than the original rate). The monthly payment increases but is still lower than it would be at the full rate.

- Year 3 onward: The interest rate resets to the original 6%, and the borrower makes payments based on this rate for the remainder of the loan term.

How the Buydown is Funded

The cost of the buydown is typically paid upfront by the borrower, seller, builder, or lender. The amount paid covers the difference between what the borrower would have paid at the original interest rate and what they pay at the reduced rate during the buydown period. For example, in a 2-1 buydown, the total buydown cost is the sum of the interest savings from the first two years.

Why Borrowers Use Temporary Buydowns

- Lower Initial Payments: A temporary buydown allows borrowers to ease into their mortgage payments, which can be especially helpful if they expect their income to increase in the near future.

- Affordability: It can make a home more affordable in the short term, which is beneficial for buyers who might be stretching their budget to purchase a home.

- Market Strategy: Sellers or builders may offer a temporary buydown as an incentive to attract buyers, especially in a slow real estate market.

Why Lenders Agree to Temporary Buydowns

- Attracting Borrowers: Temporary buydowns can make loans more attractive to borrowers, particularly in high-interest-rate environments, which helps lenders increase their loan origination volume.

- Risk Mitigation: Although the lender receives lower payments initially, they are typically compensated through the buydown fund that covers the difference. Once the temporary period ends, the lender receives the full interest rate on the loan.

- Third-Party Funding: When sellers or builders pay for the buydown, the lender faces less financial risk since the cost is covered by the third party, making it easier for them to offer such products.

A temporary buydown lowers the borrower’s interest rate and monthly payments for a limited time, providing short-term affordability. The cost is typically covered upfront, often by a seller or builder, making it a useful tool in real estate transactions to make homes more appealing to buyers.

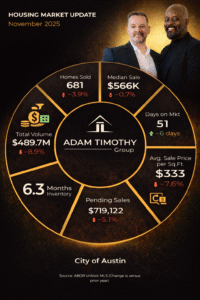

An informed client is a great partner in the real estate home buying or home selling process. We want to share with you insights on the market so that you are better informed. We are here for buyers and sellers to make sense of the often tough market. Don’t go it alone. Let’s talk today! If you need help buying, selling, or leasing out your luxury condo or single-family home, we may be a good fit for you.

Other Market Perspectives Posts

We don’t just buy and sell homes. We build community by helping clients find their place in the world.

Timothy Powles and Adam Stanley work together on the Adam Timothy Group at Compass RA and manage AT Real Estate Group LLC, a rental and vacation property investment business. We are about building community. We believe a real estate transaction is an important and extremely significant event but relationships last a lifetime. Our clients, partners, and friends trust us to get to know their story and what is most important to them. And we work tirelessly to retain that trust.

INFORMATION ABOUT BROKERAGE SERVICES

INFORMATION ABOUT BROKERAGE SERVICES