Market Perspectives Blog Post

High Mortgage Rates? Here's Why Buying or Selling a Home Now Still Makes Sense

Why Both Buyers and Sellers Are Watching Mortgage Rates

The current housing market is a tug-of-war between buyers hesitant to purchase due to high interest rates and sellers reluctant to list their homes. While both sides seem to be in a holding pattern, the reasons behind this are more nuanced than they appear. For those sitting on the fence, understanding these dynamics could reveal why now might be the perfect time to act.

What’s Keeping Buyers on the Fence?

For many prospective buyers, today’s mortgage rates—some of the highest in decades—are a significant hurdle. Higher interest rates mean higher monthly payments, causing hesitation as buyers wait for rates to drop. This focus on interest rates often leads buyers to overlook a crucial fact: waiting could cost more in the long run.

As Dave Ramsey advises, “You date the rate and marry the house.” While today’s rates may seem high, they are temporary. Refinancing opportunities will likely arise when rates eventually decline. However, what’s not temporary is the price you pay for your home. Ramsey emphasizes that waiting for interest rates to drop a fraction of a percent while home prices increase could lead to a higher overall cost of homeownership. His advice is clear: buy when you’re financially ready, not when you think the market is perfect.

Sellers Are Waiting Too

Interestingly, it’s not just buyers who are waiting for mortgage rates to decline—sellers are, too. However, their reasons are vastly different. Many homeowners are locked into historically low mortgage rates and are reluctant to sell because it would mean trading their current favorable rate for a higher one. This so-called “lock-in effect” has led to a significant drop in housing inventory.

But here’s the key: sellers are not waiting because they expect home prices to decline. In fact, most sellers believe prices will hold steady or even rise due to the constrained supply. This confidence in home values is why waiting for rates to drop might not pay off for buyers hoping to score a deal.

Ramsey points out that home prices are unlikely to fall in most markets. The continued demand for housing and low inventory mean that sellers are confident about maintaining or even increasing their asking prices, even with fewer buyers in the market.

Opportunities in Today’s Market

While both sides appear cautious, today’s market conditions actually offer unique opportunities for buyers who are prepared to move forward:

- Less Competition: Higher interest rates have reduced the number of active buyers, giving those still in the market a better chance to negotiate favorable terms.

- Seller Concessions: Many sellers who do list are motivated, offering incentives like closing cost credits, rate buy-downs, or price reductions to attract buyers.

- Future Refinancing Potential: Even if you purchase at a higher rate now, the opportunity to refinance in the future can lower your long-term costs, making homeownership more accessible.

The Cost of Waiting

For buyers on the fence, the cost of waiting can be significant. Ramsey highlights that while interest rates are a consideration, the bigger factor is affordability. Waiting for rates to drop while home prices continue to rise can lead to paying more for a home in the future. Additionally, as the market becomes more competitive in the event of falling rates, buyers could find themselves in bidding wars, driving prices even higher.

Ramsey also advises focusing on what you can afford today. He suggests keeping your monthly housing payment—including taxes and insurance—at or below 25% of your take-home pay. This ensures that buyers stay financially secure even in a high-rate environment.

How to Approach the Market

Whether you’re a buyer or seller, the key to navigating today’s market is preparation:

- Buyers: Focus on what you can afford now, keeping your monthly payment within a comfortable range. Don’t be afraid to negotiate for seller concessions, such as rate buy-downs or covering closing costs. Remember, refinancing is always an option when rates drop.

- Sellers: If you’re considering listing, recognize that serious buyers are still out there. Highlight the unique features of your property and be open to negotiations to make your home stand out.

Ramsey stresses the importance of having a financial foundation in place before buying, including:

- Being debt-free.

- Saving at least 10–20% for a down payment.

- Establishing an emergency fund covering 3–6 months of expenses.

Navigating the housing market in today’s high-interest rate environment can feel overwhelming, but it’s important to remember that opportunities still exist. Sellers are confident in their home values, and buyers who are financially prepared can secure the home they love now while planning for future refinancing options. As Dave Ramsey highlights, the focus should always be on affordability, long-term planning, and making decisions aligned with your financial goals—not on waiting for the perfect moment.

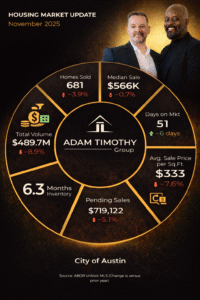

At Adam Timothy Group, we understand that buying or selling a home isn’t just a transaction; it’s a milestone that shapes your future. That’s why we’re committed to walking alongside our clients every step of the way, ensuring their goals, dreams, and priorities are at the forefront. Whether you’re ready to make a move or simply exploring your options, our team offers expert guidance, honest advice, and personalized strategies tailored to today’s market challenges.

Let’s make your real estate journey one of confidence, clarity, and success. Reach out to the Adam Timothy Group today—your trusted partner for navigating the complexities of the housing market with unwavering support.

Sources: The Street, MarketWatch, Ramsey Solutions, GoBankingRates

Other Market Perspectives Posts

We don’t just buy and sell homes. We build community by helping clients find their place in the world.

Timothy Powles and Adam Stanley work together on the Adam Timothy Group at Compass RA and manage AT Real Estate Group LLC, a rental and vacation property investment business. We are about building community. We believe a real estate transaction is an important and extremely significant event but relationships last a lifetime. Our clients, partners, and friends trust us to get to know their story and what is most important to them. And we work tirelessly to retain that trust.

INFORMATION ABOUT BROKERAGE SERVICES

INFORMATION ABOUT BROKERAGE SERVICES