Understanding the Required Compliance Forms for Homebuyers in Austin

At Adam Timothy Group, we believe that transparency and education are key parts of the homebuying process. If you’re buying a home in Austin—or anywhere in Texas—there are several standard compliance forms we provide to make sure you’re informed and protected throughout the process. Here’s a brief explanation of each one you’ll come across as a buyer.

Are Open Houses Worth It? Yes—but Not for the Reason You Think

Open houses have long been a staple of the home-selling process. But let’s be honest—they’re not magic. At Adam Timothy Group, we tell our clients the truth: open houses are just one piece of the puzzle, and they’re rarely the reason a home actually sells.

Essential Lease Prohibitions Every Texas Landlord Should Know

The Texas Association of Realtors (TAR) Standard Lease includes specific prohibitions that help protect both the tenant and landlord while ensuring the property is maintained properly and legally. These clauses are commonly found in most residential leases across Texas, and they are particularly important for ensuring that tenants use the property responsibly.

Why Pricing Your Home Right the First Time Maximizes Value and Minimizes Stress

Pricing a property correctly from the start is one of the most critical factors in achieving a successful sale. It’s a topic that can sometimes be met with resistance from sellers, but the reality is this: there is no real benefit to overpricing a home just to “leave room to negotiate.” In fact, doing so can end up costing you more in the long run.

How Lenders Use Appraisals and When an Appraisal Can Change—Impacting a Transaction

Home appraisals play a crucial role in real estate transactions, particularly for lenders who rely on them to assess the fair market value of a property before issuing a mortgage. While appraisals are meant to provide a neutral, data-driven valuation, they are not always final. In some cases, an appraisal can be revised mid-process, unexpectedly lowered, or even completely overturned—jeopardizing a transaction and forcing buyers, sellers, and agents to rethink their plans.

Maximize Your Property Tax Savings in 2025

From filing or updating your homestead exemption to checking for additional tax breaks, this guide will help you take control and start the year on the right foot.

Mastering Your Homeowners Insurance for Savings and Peace of Mind

As part of our New Year Resolution series, let’s focus on a resolution you can actually keep—understanding your homeowners insurance. With rising premiums and shifting discounts, now is the perfect time to ensure you’re getting the best value while protecting your home. From uncovering what’s truly covered to navigating the post-storm premium hikes, this guide will help you take control of your policy, save money, and start the year with peace of mind.

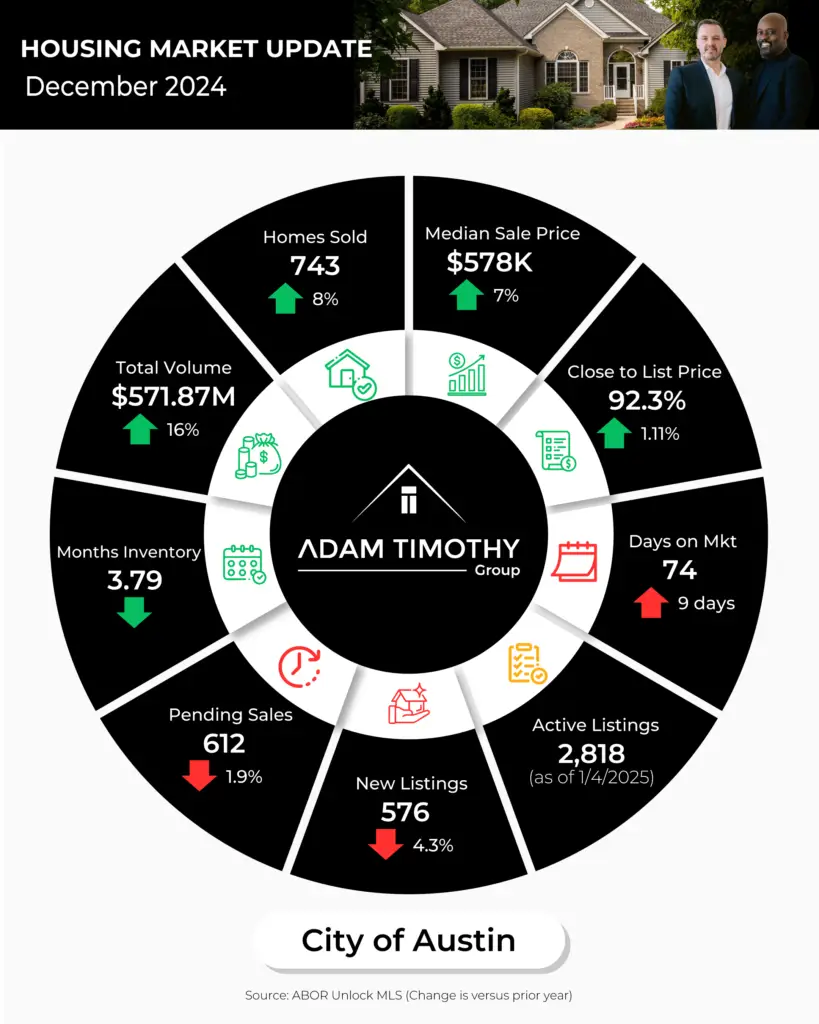

December 2024 Austin Real Estate Market Update: Key Insights & Trends

Great news for Austin’s housing market! Compared to December 2023, homes sold are up 8%, and total sales volume increased by a whopping 16%! Sellers are getting smarter with pricing, as close-to-list price ratios are improving. While days on market are slightly higher, inventory is more balanced, creating opportunities for both buyers and sellers.

Choosing the Right Platform for Rent Collection and Tenant Coordination

Market Perspectives Blog Post Choosing the Right Platform for Rent Collection and Tenant Coordination As a landlord, managing your rental properties efficiently is crucial for maintaining a harmonious relationship with your tenants and ensuring the financial health of your real estate investments. One of the most significant aspects of this management is the collection of […]

Fed Rate Cuts Are Here—But Why Aren’t Mortgage Rates Dropping?

The Fed also updated its economic outlook, and the takeaway is that we might see stronger growth and lower unemployment in 2025—but also slightly higher inflation. Because of that, they’ve scaled back their rate cut predictions for next year from four cuts to just two. Of course, if unemployment starts to climb, they’ve hinted they’ll act faster to adjust.