What Austin Homebuyers Need to Know About Lead & Asbestos Testing

What Austin Homebuyers Need to Know About Lead & Asbestos Testing | Adam Timothy Group Buyer Resources • Home Safety What Austin Homebuyers Need to

Homeownership is more than just a place to call home; it plays a pivotal role in shaping your financial future. While renting may offer flexibility, owning a home offers substantial long-term benefits that can dramatically enhance your net worth. Here’s a closer look at how homeownership can impact your financial health:

1. Equity Building

One of the most significant advantages of owning a home is the equity you build over time. Every mortgage payment you make contributes to your equity—the portion of the home’s value that you actually own. Unlike rent, which is an expense with no return, each payment on a mortgage increases your ownership stake in your property. As property values appreciate, the equity in your home can grow substantially, contributing positively to your net worth.

2. Appreciation Potential

Historically, real estate has proven to be a strong investment due to its potential for appreciation. While market conditions fluctuate, property values generally increase over the long term. This appreciation can significantly boost your net worth as the value of your home rises, especially if you’ve purchased in a desirable location or made home improvements that enhance its value.

3. Tax Advantages

Homeownership offers several tax benefits that can contribute to your financial well-being. Mortgage interest payments and property taxes are often tax-deductible, reducing your taxable income and potentially lowering your tax bill. Additionally, if you sell your home for a profit, you may be eligible for tax-free capital gains up to a certain limit, depending on how long you’ve owned and lived in the home.

4. Stable Housing Costs

Owning a home provides more predictable housing costs compared to renting. With a fixed-rate mortgage, your principal and interest payments remain consistent throughout the life of the loan, offering stability in your budget. This predictability can help you plan your finances better and avoid the uncertainty of fluctuating rent prices.

5. Long-Term Investment

Unlike renting, which is often seen as a short-term solution, homeownership is a long-term investment. Over time, the cumulative effect of your mortgage payments, combined with property appreciation, can lead to substantial financial gains. Homeownership also offers a hedge against inflation, as property values and rental prices typically rise with inflation, but your fixed-rate mortgage remains the same. Home equity does more to build the average household’s wealth than anything else. According to data from First American and the Federal Reserve, this holds true across different income levels (see graph below):

6. Wealth Transfer

A home can also serve as a valuable asset to pass on to future generations. The equity you build and the appreciation of your property can become part of your estate, providing financial benefits to your heirs. This transfer of wealth can help secure the financial future of your family and contribute to generational wealth. Every three years, the Federal Reserve releases the Survey of Consumer Finances (SCF), which compares net worth for homeowners and renters. The latest report shows the average homeowner’s net worth is almost 40X greater than a renter’s (see graph below):

At Adam Timothy Group, we understand the significant impact that homeownership can have on your net worth and overall financial health. Our team is dedicated to guiding you through the home buying process to ensure you make informed decisions that align with your financial goals. Contact us today to explore how we can help you achieve your homeownership dreams and build your wealth for the future.

Sources:

What Austin Homebuyers Need to Know About Lead & Asbestos Testing | Adam Timothy Group Buyer Resources • Home Safety What Austin Homebuyers Need to

Complete Guide to Austin Neighborhoods | Adam Timothy Group Your Complete Guide to Austin Neighborhoods Explore nine of Greater Austin’s most sought-after areas. From urban

We hear it constantly from clients, from friends, from strangers at open houses: “Should I rent or should I buy?” And every time, the same well-meaning advice follows. The financial news sites publish their monthly scorecards. The online calculators spit out a number. Your uncle at Thanksgiving has strong opinions.

Access to excellent medical care is rarely a limiting factor when choosing a community. With multiple nationally-ranked hospital systems strategically positioned throughout the five-county metro, most areas offer strong healthcare options within minutes. That said, understanding the landscape helps—so here’s your complete guide.

Legacies: Black Excellence | Adam Timothy Group Every Month is Black History Month because Black History is American History Legacies Black Excellence Celebrating the trailblazers

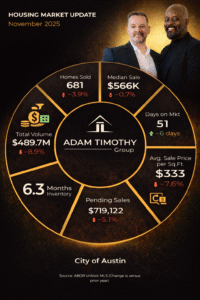

Austin Market Update • November Austin Housing Inventory Is Up: What November Means for Buyers and Sellers Inventory is changing how decisions get made in

We don’t just buy and sell homes. We build community by helping clients find their place in the world.

Timothy Powles and Adam Stanley work together on the Adam Timothy Group at Compass RA and manage AT Real Estate Group LLC, a rental and vacation property investment business. We are about building community. We believe a real estate transaction is an important and extremely significant event but relationships last a lifetime. Our clients, partners, and friends trust us to get to know their story and what is most important to them. And we work tirelessly to retain that trust.

INFORMATION ABOUT BROKERAGE SERVICES

INFORMATION ABOUT BROKERAGE SERVICES

We may use cookies and similar technologies to improve your browsing experience, analyze website traffic, and personalize content. By continuing to use this site, you consent to our use of cookies in accordance with our Privacy Policy. You can change your cookie preferences at any time in your browser settings.

Manage your cookie preferences below:

Essential cookies enable basic functions and are necessary for the proper function of the website.

These cookies are needed for adding comments on this website.

Statistics cookies collect information anonymously. This information helps us understand how visitors use our website.

Google Analytics is a powerful tool that tracks and analyzes website traffic for informed marketing decisions.

Service URL: policies.google.com (opens in a new window)

Marketing cookies are used to follow visitors to websites. The intention is to show ads that are relevant and engaging to the individual user.

OptinMonster is a powerful lead generation tool that helps businesses convert visitors into subscribers and customers.

Service URL: optinmonster.com (opens in a new window)

You can find more information in our Privacy Policy.