What Austin Homebuyers Need to Know About Lead & Asbestos Testing

What Austin Homebuyers Need to Know About Lead & Asbestos Testing | Adam Timothy Group Buyer Resources • Home Safety What Austin Homebuyers Need to

Homebuyers seek warranties to ensure protection against construction defects, providing peace of mind and financial security. A home warranty can become essential in the home buying process as they cover potential issues with workmanship, materials, and major structural components. These warranties also serve as a competitive advantage for builders, setting a standard in the industry.

The average cost for structural repairs can be substantial, though costs can range widely depending on the severity and type of repairs needed. For example, basic structural repairs might cost around $5,000, while more extensive repairs, such as lifting a foundation, can run between $20,000 and $23,000. Consequently, having insurance coverage for these potential expenses is crucial for homeowners. The high cost of repairs underscores the importance of comprehensive warranties and the financial protection they offer, making them a vital aspect of real estate transactions.

The cost of providing 1/2/10 home warranties varies based on several factors, including the number and average value of homes built, the reputation and history of the builder, and the specific area. Generally, warranty costs range from $300 to $600 per home per year, influenced by the builder’s track record and the overall volume of homes covered. One of the largest providers estimates costs at approximately $3.50 per $1,000 of home value. Larger builders with a positive reputation may benefit from lower rates due to economies of scale and lower risk assessments by warranty providers.

By offering a new-home warranty on every home you sell, you communicate to your buyers that you build a quality product and stand behind your work. This creates buyer confidence and results in a quicker sale and more satisfied customer. And, as buyers are becoming more savvy about home buying and their builder options, choosing a builder that offers warranty protection is becoming a more common requirement.

In June 2023, Texas updated its statute of repose, reducing the period during which buyers can sue builders for construction defects from ten years to six years. This change applies to detached one- and two-family homes and townhomes, provided the builder issues a written warranty meeting specific terms: one year for workmanship and materials, two years for plumbing, electrical, heating, and air-conditioning systems, and six years for major structural components. While this may eventually make a 1/2/6 warrantee more common, current listings seem to show Builders sticking to the 1/2/10.

Home warranties are a crucial aspect of the home buying process in Texas, providing buyers with confidence and financial protection. The recent changes in the statute of repose emphasize the importance of offering robust warranties. Builders who provide comprehensive 1/2/10 warranties not only meet legal requirements but also stand out in the market, attracting more buyers and ensuring higher satisfaction.

What Austin Homebuyers Need to Know About Lead & Asbestos Testing | Adam Timothy Group Buyer Resources • Home Safety What Austin Homebuyers Need to

Complete Guide to Austin Neighborhoods | Adam Timothy Group Your Complete Guide to Austin Neighborhoods Explore nine of Greater Austin’s most sought-after areas. From urban

We hear it constantly from clients, from friends, from strangers at open houses: “Should I rent or should I buy?” And every time, the same well-meaning advice follows. The financial news sites publish their monthly scorecards. The online calculators spit out a number. Your uncle at Thanksgiving has strong opinions.

Access to excellent medical care is rarely a limiting factor when choosing a community. With multiple nationally-ranked hospital systems strategically positioned throughout the five-county metro, most areas offer strong healthcare options within minutes. That said, understanding the landscape helps—so here’s your complete guide.

Legacies: Black Excellence | Adam Timothy Group Every Month is Black History Month because Black History is American History Legacies Black Excellence Celebrating the trailblazers

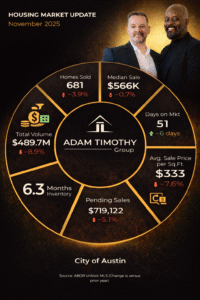

Austin Market Update • November Austin Housing Inventory Is Up: What November Means for Buyers and Sellers Inventory is changing how decisions get made in

We don’t just buy and sell homes. We build community by helping clients find their place in the world.

Timothy Powles and Adam Stanley work together on the Adam Timothy Group at Compass RA and manage AT Real Estate Group LLC, a rental and vacation property investment business. We are about building community. We believe a real estate transaction is an important and extremely significant event but relationships last a lifetime. Our clients, partners, and friends trust us to get to know their story and what is most important to them. And we work tirelessly to retain that trust.

INFORMATION ABOUT BROKERAGE SERVICES

INFORMATION ABOUT BROKERAGE SERVICES

We may use cookies and similar technologies to improve your browsing experience, analyze website traffic, and personalize content. By continuing to use this site, you consent to our use of cookies in accordance with our Privacy Policy. You can change your cookie preferences at any time in your browser settings.

Manage your cookie preferences below:

Essential cookies enable basic functions and are necessary for the proper function of the website.

These cookies are needed for adding comments on this website.

Statistics cookies collect information anonymously. This information helps us understand how visitors use our website.

Google Analytics is a powerful tool that tracks and analyzes website traffic for informed marketing decisions.

Service URL: policies.google.com (opens in a new window)

Marketing cookies are used to follow visitors to websites. The intention is to show ads that are relevant and engaging to the individual user.

OptinMonster is a powerful lead generation tool that helps businesses convert visitors into subscribers and customers.

Service URL: optinmonster.com (opens in a new window)

You can find more information in our Privacy Policy.