What Happens After Your Lease Application Is Approved in Texas?

Market Perspectives Blog Post What Happens After Your Lease Application Is Approved in Texas? So, your rental application was accepted—congrats! Whether you’re moving into a

As a landlord, managing your rental properties efficiently is crucial for maintaining a harmonious relationship with your tenants and ensuring the financial health of your real estate investments. One of the most significant aspects of this management is the collection of rent and security deposits. Selecting the right platform for these transactions can streamline the process, reduce misunderstandings, and enhance communication. Here are some recommended platforms, each with its unique benefits:

1. TurboTenant

TurboTenant offers a robust solution for landlords looking for a comprehensive tool to handle not only rent collection but also ongoing tenant communication. This platform excels in facilitating maintenance requests and automatically calculating late fees, which can be a significant advantage in managing several properties. An added convenience is its document storage capability, which can help organize leases, maintenance records, and other critical documents. The service is free for landlords, with tenants covering fees based on their payment methods.

2. RentSpree

As a platform already utilized by the Adam Timothy Group for tenant screening, RentSpree presents a seamless option for those who value continuity. Its features are similar to TurboTenant, though it offers a slightly less polished user experience. However, its integration with the tenant screening process can simplify transitions from applicant to renter. The fee structure is flexible, allowing either landlords or tenants to cover the costs.

3. Avail

Avail stands out for its user-friendly interface and comprehensive feature set, making it a favorite among landlords who prioritize ease of use and functionality. While it may be pricier for credit card transactions, ACH transfers are free with a premium account, which can be beneficial for landlords with multiple properties. Avail also offers excellent customer support, which is invaluable for resolving any issues that arise during the rent collection process.

4. PayPal, Zelle, Venmo

For landlords favoring straightforward payment solutions, platforms like Zelle, Venmo, and PayPal are viable options. Zelle does not charge fees, which is a significant advantage for direct transfers. However, Venmo and PayPal consider rent payments as business transactions and will incur fees. These platforms do not automatically transfer collected rent to your bank account, which means manual management is necessary. This could be a drawback for landlords seeking automation in their rent collection process.

Almost anything is better than checks!

Choosing the right platform for collecting rent and coordinating with tenants is more than just about financial transactions; it’s about finding a system that aligns with your management style, the complexity of your property portfolio, and your communication preferences with tenants. By selecting an appropriate platform, landlords can ensure smoother operations, timely rent collection, and improved tenant relations, ultimately leading to a more profitable and less stressful investment experience.

An informed client is a great partner in the real estate home buying or home selling process. We want to share with you insights on the market so that you are better informed. We are here for buyers and sellers to make sense of the often tough market. Don’t go it alone. Let’s talk today! If you need help leasing out your luxury condo or single-family home, we may be a good fit for you.

Market Perspectives Blog Post What Happens After Your Lease Application Is Approved in Texas? So, your rental application was accepted—congrats! Whether you’re moving into a

If you’ve been trying to sell or rent a home in Austin lately, you may be feeling confused, discouraged, or just plain stuck. You’re not alone. In fact, if you’re wondering why no one’s showing up to your open house or inquiring about your listing — join the club.

A home inspection can reveal critical issues—but not everything leads to negotiation. Learn what’s worth flagging, what’s considered normal aging, and how to use disclosures and visible wear to write a smart, informed offer.

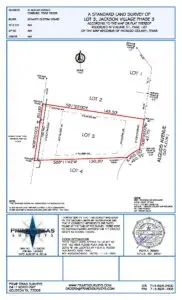

If you’ve ever looked at a home survey and seen labels like “utility easement” or “sewer easement,” you may have wondered: what do these actually mean—and why should I care? In Texas, easements give the city or utility providers the legal right to access parts of your property for specific uses, even though you still own the land.

Understanding where easements are and what they permit is essential—because while they might not impact your daily life today, they can suddenly matter a lot when you’re planning to build, landscape, or even just replace a fence.

In today’s real estate market, characterized by persistently high interest rates, many prospective homebuyers are exploring avenues to lower their interest rates without significantly increasing their upfront closing costs. One such avenue that garners attention is the interest rate buydown. Let’s delve into what exactly interest rate buydowns entail, how they function, and the different types available.

At Adam Timothy Group, we believe that transparency and education are key parts of the homebuying process. If you’re buying a home in Austin—or anywhere in Texas—there are several standard compliance forms we provide to make sure you’re informed and protected throughout the process. Here’s a brief explanation of each one you’ll come across as a buyer.