Market Perspectives Blog Post

Understanding VA Loans: A Veteran’s Path to Affordable Homeownership

Let’s talk about veteran loans in the home buying process. At Adam Timothy Group, we are proud to serve those who serve our communities and our country. Veterans, active-duty military, first responders, public school teachers, and nurses dedicate their lives to supporting others—and we believe it’s important to give back in a meaningful way. That’s why we offer a 10% rebate of our commission to clients in these groups, including veterans and active-duty military members. It’s one of the ways we put our gratitude into action.

For those who have served in the military, one of the most powerful tools available when buying a home is the VA loan. It’s a benefit you’ve earned through your service, and it can open the door to homeownership with advantages that other loan programs simply don’t provide.

A Brief Background on VA Loans

The VA home loan program was created in 1944 as part of the original GI Bill, designed to help World War II veterans return home and build stable futures for their families. Since then, it has helped more than 25 million service members, veterans, and their families become homeowners.

Unlike conventional mortgages, VA loans are backed by the U.S. Department of Veterans Affairs. The VA doesn’t lend the money directly—instead, it guarantees a portion of the loan, which reduces the risk for lenders. That guarantee is what makes the program’s unique benefits possible.

What Makes VA Loans So Valuable?

The VA loan program is designed with veterans and service members in mind. It gives you more flexibility and keeps costs lower when buying a home.

Key benefits include:

No down payment required in most cases for VA loans.

No private mortgage insurance (PMI), which keeps monthly payments affordable.

Competitive interest rates to help you save long-term.

Lower barriers to approval, making it easier to qualify.

Limits on certain closing costs, so more of your money stays in your pocket.

For many of our veteran and active-duty clients, these features mean moving into a home sooner rather than waiting years to save for a large down payment.

When VA Loans May Not Be the Perfect Fit

While VA loans are powerful, they aren’t always the best option in every scenario. For example:

If you’re purchasing a higher-end home, a jumbo conventional loan may work better.

If you’re putting down a large down payment, conventional loans sometimes save more in the long run.

In highly competitive markets, some sellers prefer conventional loans (though we work hard to overcome that misconception).

The important thing is having the right guidance to know which option truly works best for you. Every buyer’s situation is unique. That’s why we’ve created a network of trusted local lenders—including VA loan experts—who can walk you through the details and make sure you’re getting the most out of your well-earned benefits: Adam Timothy Group Mortgage Partners.

At Adam Timothy Group, we don’t just facilitate transactions—we take the time to understand your story and what matters most to you. By walking alongside you every step of the way, we ensure your goals and dreams are realized.

If you’re a veteran or active-duty service member thinking about buying a home in Austin or anywhere across the country, we would be honored to serve you. Let’s talk.

Buyers: This Is Your Window — Don’t Miss It

If you’re a buyer sitting back, waiting for the “perfect moment,” here’s some advice: get off the sidelines. We are in several key areas of Austin at 8 MONTHS OF INVENTORY.

A large portion of the current activity in Austin is being driven by investors. They see this market for what it is — a rare opportunity to buy in a corrected environment where sellers are negotiable and pricing has adjusted. They’re moving. Are you?

This is a true buyer’s market!

You can negotiate meaningful seller-paid incentives, including rate buy-downs that directly lower your monthly payment. You can buy at rightsized prices, not the inflated numbers we saw at the peak. You can choose from a wider inventory without feeling rushed or bidding against 10 other buyers. Don’t let investors be the only ones to benefit from this market. If you’re looking for a home to live in, now is the time to make strategic decisions that could set you up for years to come.

Let’s talk if you want to understand what this market means for your property — or if you’re a buyer ready to act while others are still waiting.

Other Market Perspectives Posts

Keep Austin Full of People Who Love It

We don’t just buy and sell homes. We build community by helping clients find their place in the world.

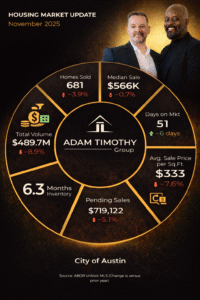

Timothy Powles and Adam Stanley work together on the Adam Timothy Group at Compass RA and manage AT Real Estate Group LLC, a rental and vacation property investment business. We are about building community. We believe a real estate transaction is an important and extremely significant event but relationships last a lifetime. Our clients, partners, and friends trust us to get to know their story and what is most important to them. And we work tirelessly to retain that trust.