Market Perspectives Blog Post

Why Rising Rents May Make Homeownership a Smart Move

In recent years, inflation has significantly impacted the cost of living, with rental prices rising faster than many other expenses. While the rising cost of mortgages garners much attention, rent prices in many areas, including Austin, have increased even more sharply. Between 2020 and 2022, Austin saw a 35% jump in rents, far outpacing inflation and mortgage interest rate increases. Average rent surged from $1,660 in early 2020 to over $2,245 by January 2022.

With rent prices rising so quickly, many renters are now considering homeownership as a more stable alternative. However, buying a home comes with its own set of pros and cons, and it’s important to consider both sides.

The Pros and Cons of Buying vs. Renting

Pros of Buying a Home:

- Fixed Mortgage Payments: When you own a home with a fixed-rate mortgage, your monthly payment remains stable, providing a safeguard against rent increases. This can make homeownership feel more predictable, even if interest rates are higher than they were a few years ago.

- Building Equity: Each mortgage payment builds equity in your home, creating long-term financial value. Over time, as the property appreciates, you can benefit from potential capital gains when selling.

- Tax Advantages for Primary Residences: Homeowners can exclude up to $500,000 of profit from the sale of their primary residence from capital gains taxes, which can lead to significant tax savings compared to other investments like stocks.

Cons of Buying a Home:

- Maintenance Costs: Unlike renting, homeownership requires you to cover all maintenance and repair expenses, from routine upkeep to unexpected repairs, which can add up over time.

- Capital Gains on Investment Properties: If you purchase a property as an investment rather than a primary residence, you won’t benefit from the same tax exclusions. Capital gains taxes of 15-20% may apply, which can diminish your overall profits when selling the property.

- Upfront Costs: Buying a home involves significant upfront costs, including a down payment, closing costs, and other fees, which may make it less accessible compared to renting.

The Pros and Cons of Renting:

Pros of Renting:

- Flexibility: Renting allows for greater mobility, making it easier to relocate for job opportunities or lifestyle changes without the long-term commitment of homeownership.

- Lower Upfront Costs: Renters don’t have to worry about down payments or covering the costs of maintenance and repairs, making it more affordable in the short term.

- No Ownership Maintenance Responsibility: Renters aren’t responsible for property upkeep, repairs, or dealing with unexpected property expenses, which can be a significant financial relief.

Cons of Renting:

- Rising Rent Costs: Renters face the risk of rising rents, often outpacing inflation and sometimes leading to unpredictable increases, as seen in Austin’s 35% rent hike between 2021 and 2022.

- No Equity Building: Rent payments do not contribute to ownership or long-term financial gains. Over time, renters may end up spending more money without building equity, as compared to homeowners who benefit from property appreciation.

- Limited Stability: Rental agreements are typically short-term, meaning there is less stability in monthly payments compared to the fixed costs of a mortgage. Renters are also subject to market forces and landlord decisions.

How We Help Landlords and Investors

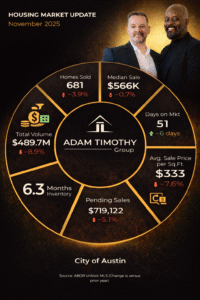

At Adam Timothy Group, we help clients navigate the complexities of the rental and housing markets:

Landlords: We assist landlords in determining the right time to raise rents based on market trends, ensuring they maximize income while keeping tenants satisfied.

Renters to Buyers: For those considering transitioning from renting to buying, we provide detailed comparisons of the long-term costs of both, helping clients make informed decisions that align with their financial goals.

Investors: For investors, we help identify high-potential rental properties and navigate the complexities of taxes, maintenance, and rental management to ensure their investments are profitable in the long run.

There are pros and cons to both renting and buying, and the decision ultimately depends on individual circumstances. Whether you’re a renter, homeowner, or investor, Adam Timothy Group is here to guide you through the process and help you make the best decision for your future.

Other Market Perspectives Posts

We don’t just buy and sell homes. We build community by helping clients find their place in the world.

Timothy Powles and Adam Stanley work together on the Adam Timothy Group at Compass RA and manage AT Real Estate Group LLC, a rental and vacation property investment business. We are about building community. We believe a real estate transaction is an important and extremely significant event but relationships last a lifetime. Our clients, partners, and friends trust us to get to know their story and what is most important to them. And we work tirelessly to retain that trust.

INFORMATION ABOUT BROKERAGE SERVICES

INFORMATION ABOUT BROKERAGE SERVICES