Market Perspectives Blog Post

A New Year Resolution You Can Keep: Maximize Your Property Tax Savings in 2025

This is the second blog in our New Year Resolution series, designed to help homeowners protect their investments and save money in 2025. After exploring how to optimize your homeowners insurance in the first blog, we’re turning our focus to property taxes. With rising costs and changing regulations, managing your property taxes effectively can make a significant difference in your finances. From filing or updating your homestead exemption to checking for additional tax breaks, this guide will help you take control and start the year on the right foot.

Property taxes are a major recurring expense for homeowners, funding essential services like schools, public safety, and infrastructure. However, they can also fluctuate significantly due to rising home values and changing tax rates. By proactively managing your property taxes, you can reduce your financial burden while ensuring you’re paying only your fair share.

File or Update Your Homestead Exemption

One of the easiest and most effective ways to lower your property tax bill is by filing or updating your homestead exemption.

A homestead exemption reduces the taxable value of your home, directly lowering the amount of property taxes you owe. For example, if your home is valued at $300,000 and you qualify for a $20,000 exemption, you’ll only pay taxes as if your home were worth $280,000.

This tax break is available to homeowners who use their property as their primary residence. Additionally, if your circumstances have changed, you may now qualify for other exemptions. Ask yourself:

- Have you turned 65? Many jurisdictions offer significant additional exemptions for seniors, which can greatly reduce your tax liability.

- Are you a veteran or a disabled veteran? Veterans often qualify for special exemptions, and disabled veterans may even qualify for a full exemption in some cases.

- Have you become disabled? Individuals with disabilities may qualify for exemptions that can significantly lower their taxes.

Filing your exemption has never been easier. Many counties now allow online applications, but if this isn’t an option in your area, you can mail the necessary forms to your local appraisal district. Remember to update your driver’s license or state ID to reflect the address of your homestead property, as this is a requirement for approval.

For more details and a step-by-step guide, visit our blog: Tax Exemptions for Homeowners in Texas.

Protest Your Property Taxes

Even if you’ve filed your homestead exemption, you may still be paying more than you should if your property has been over-assessed. Property assessments can sometimes lag behind market trends, leading to inflated valuations. If you believe your property’s assessed value is too high, you have the right to protest.

The process typically involves providing evidence, such as recent comparable home sales, an independent appraisal, or data showing inaccuracies in your property’s assessment. Many homeowners who protest successfully reduce their assessed value and save hundreds or even thousands of dollars in taxes.

For a detailed guide on how to file a protest, check out our blog: Protest Your Property Taxes.

Why This Resolution Matters

Proactively managing your property taxes is a simple yet powerful way to take control of your finances. Filing or updating your homestead exemption ensures you’re taking advantage of available savings, while protesting an over-assessed property protects you from overpaying.

By combining this resolution with the steps from the first blog in our series on optimizing your homeowners insurance, you can create a strong foundation for financial security in 2025.

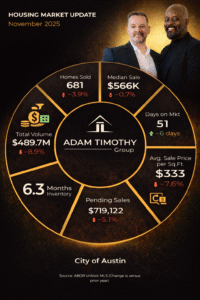

Need assistance? The Adam Timothy Group is here to help. Whether you have questions about exemptions, need guidance on filing a protest, or want to discuss any other aspect of homeownership, we’re just a call or email away.

Stay tuned for the next blog in our New Year Resolution series. Here’s to starting the year strong with practical steps that truly make a difference!

Other Market Perspectives Posts

We don’t just buy and sell homes. We build community by helping clients find their place in the world.

Timothy Powles and Adam Stanley work together on the Adam Timothy Group at Compass RA and manage AT Real Estate Group LLC, a rental and vacation property investment business. We are about building community. We believe a real estate transaction is an important and extremely significant event but relationships last a lifetime. Our clients, partners, and friends trust us to get to know their story and what is most important to them. And we work tirelessly to retain that trust.

INFORMATION ABOUT BROKERAGE SERVICES

INFORMATION ABOUT BROKERAGE SERVICES