78751 Housing Market Forecast: Navigating Post-Pandemic Realignment and Predicting the New 'Normal'

Navigating the Return to Normal in the 78751 Housing Market

The COVID-19 pandemic undeniably transformed various facets of our lives, and the housing market is no exception. In the 78751 zip code, as with many other areas, the pandemic has caused a significant deviation from what we might consider a ‘normal’ market. However, it’s crucial to understand that returning to normalcy doesn’t necessarily mean reverting to 2019 prices.

Historical Context of Housing Prices

Historically, housing prices have shown a consistent increase over any 10-year period. This trend suggests that housing markets have an inherent capability to self-correct and align with broader economic patterns over time.

Calculating the ‘Normal’ Price Point

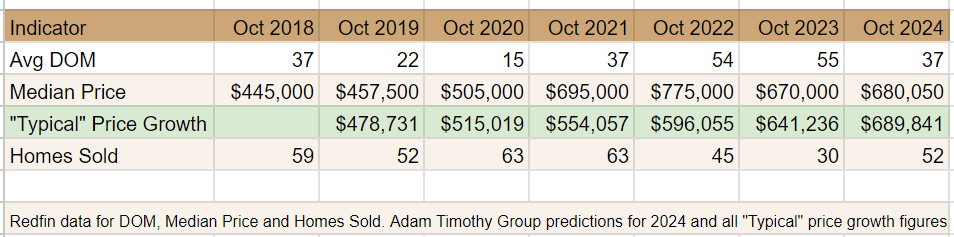

To better understand this phenomenon, let’s delve into some specific figures. From 2010 to 2023, total appreciation in the zip code was approximately 195%. The annual appreciation rate, assuming compound interest, for this total appreciation would be approximately 8.68%. However, if we consider the period from 2010 to 2019, effectively excluding the pandemic years, the annual appreciation rate drops slightly to around 7.58%.

These calculations are based on FHFA data and the FHFA House Price Calculator for the Austin MSA. It’s important to note that the median price for the Austin MSA is lower than that of 78751, so there may be some discrepancies in my analysis so this is simply illustrative. The FHFA House Price Calculator doesn’t predict the actual value of a specific house but rather projects what a house purchased at a certain time would be worth today, given the average appreciation rate of all homes in the area.

Current Market vs. Calculated ‘Normal’

As of October 2023, the median price in the 78751 area stood at $670,000. However, according to our calculated ‘normal’ trajectory, the price should have been around $641,236. This discrepancy can partly explain why the number of homes sold was lower than the 5-year average of 56 for the area. Only 30 homes sold in October 2023.

Looking ahead, by next year, the calculated ‘typical’ price point is expected to be higher than the predicted median price by sources like Redfin. This alignment suggests that we are on the cusp of returning to a ‘normal’ market.

What Does ‘Normal’ Mean in the Post-Pandemic Era?

As we anticipate this realignment, it’s essential to recognize that ‘normal’ in the post-pandemic era may not mirror the past exactly. The real estate market, much like other sectors, is dynamic and influenced by a multitude of factors beyond just historical trends. The calculated price points serve as a useful benchmark, but the actual trajectory will depend on a variety of factors including economic conditions, consumer confidence, and housing policies.

In essence, while the pandemic has indeed skewed the housing market, the inherent resilience and historical trends suggest a gradual return to equilibrium. For homeowners and potential buyers in the 78751 area and beyond, this means keeping an eye on the market trends while also being mindful of the broader economic landscape that continues to evolve in the aftermath of a global pandemic.