If you’re trying to decide whether to rent or buy a home this year, here’s a powerful insight that could give you the clarity and confidence you need to make your decision.

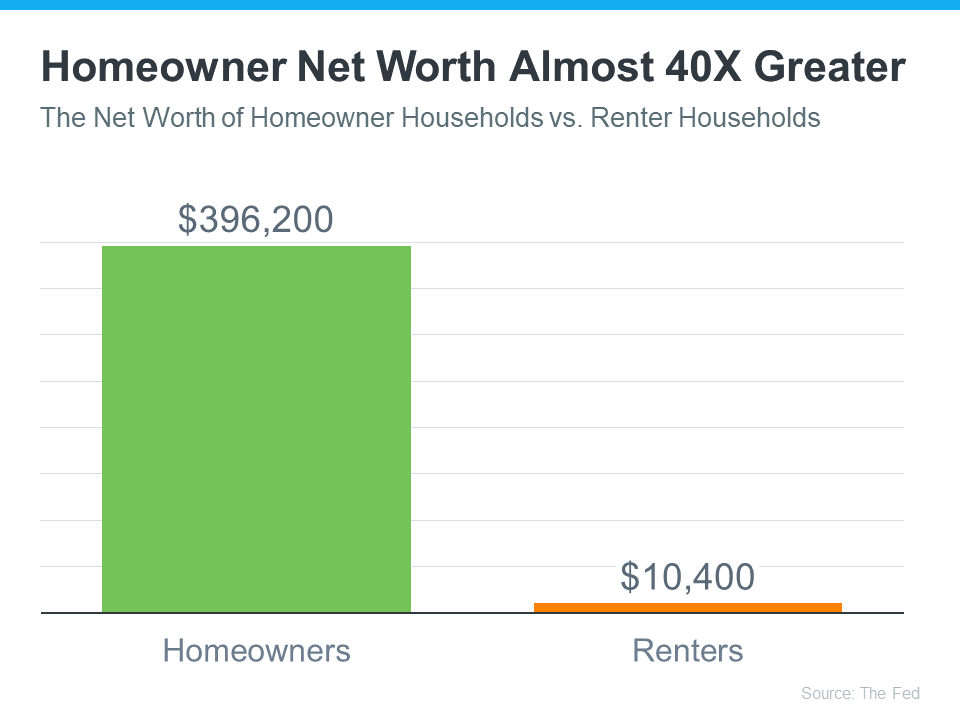

Every three years, the Federal Reserve releases the Survey of Consumer Finances (SCF), which compares net worth for homeowners and renters. The latest report shows the average homeowner’s net worth is almost 40X greater than a renter’s (see graph below):

One reason a wealth gap exists between renters and homeowners is because when you’re a homeowner, your equity grows as your home appreciates in value and you make your mortgage payment each month. When you own a home, your monthly mortgage payment acts like a form of forced savings, which eventually pays off when you decide to sell. As a renter, you’ll never see a financial return on the money you pay out in rent every month. Ksenia Potapov, Economist at First American, explains it like this:

“Renters don’t capture the wealth generated by house price appreciation, nor do they benefit from the equity gains generated by monthly mortgage payments . . .”

The Largest Part of Most Homeowner Net Worth Is Their Equity

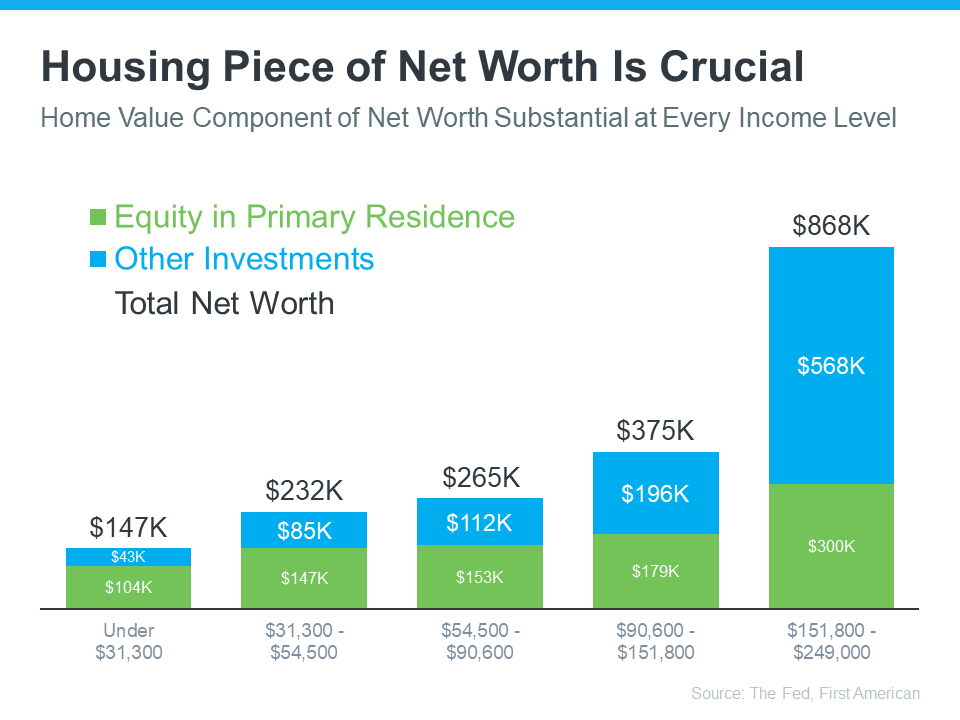

Home equity does more to build the average household’s wealth than anything else. According to data from First American and the Federal Reserve, this holds true across different income levels (see graph below):

The green segment in each bar represents how much of a homeowner’s net worth comes from their home equity. Based on this data, it’s clear no matter what your income level is, owning a home can really boost your wealth. Nicole Bachaud, Senior Economist at Zillow, shares:

“The biggest asset most people are ever going to own is a home. Homeownership is really that financial key that helps unlock stability and wealth preservation across generations.”

If you’re ready to start building your net worth, the current real estate market offers several opportunities you should consider. For example, with mortgage rates trending lower lately, your purchasing power may be higher now than it has been in months. And, with more inventory coming to the market, there are more options for you to consider. A local real estate agent can walk you through the opportunities you have today and guide you through the process of finding your ideal home.

Bottom Line

If you’re unsure about whether to rent or buy a home, keep in mind that owning a home can increase your overall wealth in the long run, no matter your income. To discover more about this and the many other benefits of homeownership, connect with a local real estate agent.